Two United States-based entities of the WE organization have spent over $3 million (U.S.) on consultants since 2014, including payments to political strategists, marketing companies, and several hundred thousand dollars to a change-management specialist whom the Kielburger brothers have publicly referred to as their “life mentor” and “trusted friend.”

The fees are part of millions of dollars in annual expenses incurred by WE Charity (U.S.) and the ME to WE Foundation (U.S.), according to annual filings with the state of New York’s Charities Bureau and the Internal Revenue Service (IRS). The entities are incorporated separately from their Canadian counterparts.

Canada Revenue Agency filings do not require a break-out of specific consulting expenses, so it is unclear what WE Charity has spent in this area in Canada.

WE Charity did not address a detailed list of questions sent by Canadaland on Tuesday. Its reply was an automated email response stating, “Since the beginning of this process, we have been as transparent and open as possible” and that they have “responded to over a thousand media questions” and “announced changes to our organizational structure and a commitment to improving our governance.”

On Tuesday, when founders Craig and Marc Kielburger spent four hours testifying at the House of Commons Finance Committee about the WE organization’s relationship with the Trudeau government, a number of MPs asked about the extensive network of incorporated entities that fall under the WE umbrella in Canada and elsewhere.

The U.S. entities are vehicles to raise funds in that country for the organization’s charitable works. The corporate address for both is a law firm in the village of Williamsville, just outside of Buffalo. Their U.S. auditors are an accounting firm in Niagara Falls, NY. WE Charity had a total of 69 employees across the U.S., according to its 2019 IRS filing, and the ME to WE Foundation did not have any.

In terms of consulting fees that the U.S. entities have paid out, two of the recipients have been, and continue to be, very public supporters of the organization, cited by WE as independent assessors of its good works. What has not been made prominent when highlighting these endorsements is the extent of the compensation paid out to David Baum and to Mission Measurement LLC, a Chicago-based company founded by Jason Saul.

From 2014 to 2016, Mission Measurement billed WE just over $1.3 million (all figures in U.S. dollars) in consulting fees. Mission Measurement describes itself as a company that can help organizations measure the social impact of their programs. “We think of social impact as a science,” the company states on its website.

Quantifying the impact of its activities is a common theme in WE’s annual reports. In 2018, it stated that its WE Villages programs have “empowered” over 30,000 women with financial independence and that students who participated in the WE Schools initiative that year created over $265 million in social value globally.

The WE Charity website features an interview with Saul, the chief executive of Mission Measurement, in which he is effusive in his praise for the organization. There is no reference to the consulting fees his company received.

In a column syndicated across Postmedia newspapers in 2015, Craig Kielburger argued that there were too many charitable foundations duplicating each other’s efforts. Comments that Saul made on the issue were cited by Kielburger in support of his argument. At the time, Saul’s company was providing paid consulting services for WE, which was not disclosed.

Saul continues to defend the charity publicly, including in a message to The Globe and Mail on July 15 and in an opinion piece published last week by Postmedia’s Ottawa Citizen and Vancouver Sun.

“We should be asking about outcomes, not just overhead,” he wrote in his op-ed. “Most charity critics and watchdogs resort to low-hanging fruit: focusing on the ‘gotcha’ game and picking on overhead costs or governance issues,” he added. (The day prior, WE had sent a news release sharing a letter that accused the watchdog group Charity Intelligence of having made “inaccurate, incomplete, and misleading statements to the media.”)

Saul’s column referred to his company only as being a “past evaluator” of WE Charity. Neither Saul nor Mission Measurement responded to requests for comment.

David Baum, a New Hampshire-based consultant who describes himself as a “conversation architect,” was paid just over $750,000 for consulting work for WE from 2015 to 2019, according to IRS filings.

Baum has consulted for a number of large corporations in the area of organizational change and features Craig Kielburger on his business website. “An invaluable mentor over many years. We couldn’t have done it without him,” is the quote from Kielburger, accompanied by his photo.

An opinion piece written by Craig and Marc Kielburger for Postmedia’s newspapers in 2015 suggested that men need life mentors. “In our lives, that someone is our trusted friend David Baum,” they wrote. Canadaland has previously reported that Baum presided over the ceremony at Craig Kielburger’s 2016 wedding.

In 2018, Baum was commissioned to investigate the human-resources practices of WE Charity. “The leadership at all levels of WE is truly impressive with a level of dedication not often seen in the nonprofit world, let alone the corporate sector,” wrote Baum in his report [pdf].

Baum did not respond to requests for comment but has previously told Canadaland that his reports were prepared “in an independent and unbiased capacity.”

Speaking generally, Sherena Hussain, an assistant professor at the Schulich School of Business at York University in Toronto, says that charities and their boards have to be diligent about the “optics” of their operations because of their special tax status.

“Directors are to avoid conduct that creates a conflict between their duty to act in the best interest of the charitable organization, and their own personal interests,” Hussain says, explaining that this is a key responsibility for the board of directors of any charity.

In the fiscal year ending August 31, 2019, WE paid $311,977 to Milbank LLP for legal services. Tawfiq Rangwala, a partner at the New York City law firm, is a member of the board of directors of WE Charity (U.S.).

“WE Charity retained Milbank with respect to certain IP and trademark issues in the U.S. The engagement was unrelated to my board services,” says Rangwala, whose practise is not in that area of law. Further inquiries about the retainer should be directed to WE Charity, he explains.

A note in the IRS filing in 2019 stated that “founding members approval is required” to admit new members to the board.

![Political: The President of [redacted] faced a national and international challenge to his legitimacy from the opposition party. With our polling, strategy development, media coaching, speechwriting, and immersive communications consulting, the President retained his power and served out his term as a leading voice in Africa.](https://www.canadalandshow.com/wp-content/uploads/2020/07/202casestudy.jpg)

There were additional consulting expenses that year, totalling just over $425,000 to political consulting companies 202 Strategies LLC and Firehouse Strategies. 202 is based in Louisiana and headed by Steve Miller, a former protégé of Democratic strategist James Carville. Miller did not respond to a request for comment. Firehouse Strategies is based in Washington, DC, and was started by former senior staff members on Florida Senator Marco Rubio’s 2016 campaign for the Republican nomination for president.

Last year, Canadaland reported on links between different Rubio-connected strategists and a series of op-eds in American and Canadian newspapers that appeared intended to discredit Canadaland’s reporting on WE. Asked in June 2019 about a half dozen individuals and another firm connected to those articles, WE said it “had no relationship(s) whatsoever” with them.

“Our efforts were focused on supporting WE Charity’s WE Day events, specifically in key regions in the United States, including Washington, DC,” says Matt Terrill, a partner at Firehouse.

While WE Day events have been held in a number of U.S. cities, none have taken place in Washington, DC.

The ME to WE Foundation (U.S.) listed just over $250,000 (U.S.) in payments to consultants from 2014 to 2019, although the recipients are not identified.

WE Charity (U.S.) posted a loss of $1.45 million in the fiscal year ending August 31, 2019, with revenues of $31.14 million and expenses totalling $32.59 million, according to its IRS filing.

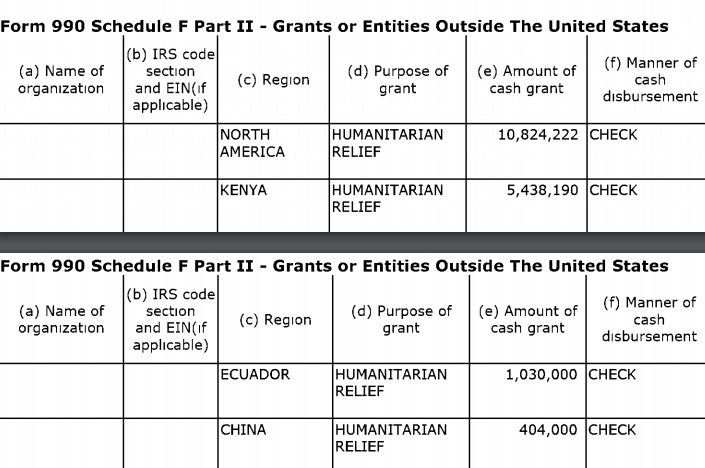

In the category for “activities outside the United States,” it listed expenditures of $10.8 million in North America for “humanitarian relief” and “grantmaking” efforts and just over $8 million for expenditures in other parts of the world. WE Charity’s Canadian arm has previously declined to specify how much of its own international-program expenditures were made domestically.

The ME to WE Foundation (U.S.) posted a gain of nearly $1.2 million last year, on total revenue of $9.9 million. In outlining its program service accomplishments, it referred to holding speeches at schools and colleges and sponsoring trips to educate youth about social issues impacting children.

The IRS filing disclosed that more than two thirds of contributions came from a small number of sources. “Several national retailers made large contributions during the year in connection with promotions for the sale of specially identified products,” it explained.

The foundation had relatively modest revenue until the year ending August 31, 2018, when it brought in $5.4 million. During the previous four years, annual revenue was in the $1 million range.

The ME to WE Foundation (U.S.) has had the same three board members/officers since the foundation was registered in the U.S. in 2010. Two are long-time senior employees of the Canadian WE Charity — chief financial officer Victor Li and Dalal Al-Waheidi, its current executive director.

In the 2014 fiscal year, WE Charity U.S. paid $255,000 to Tether, a Seattle-based company, for brand design services. In a quote shared by WE in 2018, Tether’s founder affirmed that “The WE brand was designed to ensure absolute clarity between entities in a way that consumers would easily understand.”

Top image of the Office Park of Williamsville in Erie County, NY, from Google Street View.